Commerzbank Predicts Rising Gold Price For 2013

Commodity analysts of Commerzbank predict a further increase of the price of gold in 2013. They forecast an average gold price in 2013 of US$ 1,950 per ounce.

The analysts consider it as likely that the price of gold will at least temporarily exceed US$ 2,000 in the coming year. This could happen as soon as in the first quarter of 2013 if the US would not find a sustainable solution for the budget dispute and an increase of the debt limit would take long.

The most important price driver is expected to be central banks extremely loose monetary policy which would undermine the value of the currencies. Additionally, the debt crisis in the euro zone and the geopolitical risks in the Middle East are considered to be important drivers for a sustained demand for gold as a safe haven.

| Time Frame |

|---|

How Do Us Interest Rates Impact Future Gold Prices

The level of US interest rates is an important driver of future gold prices. When investing in gold, the investor is faced with the opportunity cost of gold – a non-interest bearing asset. The higher the US interest rate for holding US dollars or investing in Treasuries, the higher the opportunity cost of holding gold. It is more likely, therefore, that a rally in the price of gold will be forecasted the lower the US benchmark interest rate.

Gold Price Forecast For 2022 And Beyond

Forecasts for the gold price outlook next year from different analysts vary, based on how they expect the market to respond to inflation and central bank policy.

Technical analysis from brokerage firm Zaner on 8 December noted that key points on the upside in gold are the 200-day moving average at $1,796.25 and then again at $1,800.

But, even though we leave the bull camp with a minor edge, the precious metals markets lack a definitive bullish fundamental storyline and lack upside momentum. Furthermore, recent gains have been forged on extremely low trading volume and almost no change in open interest, the companys analysts wrote in a note to clients.

Analysts at Australian bank ANZ expect gold to find support in the first half of next year but undergo downward pressure later in the year when the Fed is expected to raise interest rates. They wrote in their latest commodity report: As ultra-loose monetary policy nears an end and stimulus starts to shrink, support for the precious metals sector likely to wane in 2022. Despite more than a year of US Federal Reserve discussions around tapering, higher inflation and negative real interest rates have protected the downside of gold prices.

They added: In fact, with both an accelerated taper and more than three rate hikes already priced in for 2022, the balance of risks for gold positioning remains to the upside, as geopolitical risks and virus risk could catalyse a positioning reshuffling.

Don’t Miss: War Thunder 10000 Golden Eagles Code

Goldman Sachs Lowers Its Gold Price Forecast For 2013 And 2014

According to a study by Goldman Sachs, analysts of the U.S. investment bank expect the price of gold to stagnate around 1,320 U.S. dollars by year-end. By the end of 2014, the price will drop to 1,050 U.S. dollars. According to the analysts, the precious metal will be listed in the next few years on average at U.S. dollars 1,200.

The reason for the current drop in the precious metals price are surprisingly positive data from the U.S. and the concomitant fear of a monetary policy change. The prospect of an end to the ultra-loose monetary policy has led Goldman Sachs to lower its forecast for the gold price.

| Time Frame |

|---|

Gold Price Prediction For December 2021

The below gold price forecast article is based on one of our premium gold analyses. Enjoy:

Due to golds sharp daily upswing on Dec. 16, the yellow metal moved slightly above its rising support / resistance line, which could imply another very short-term upswing.

On Dec. 10, I warned on that gold could enjoy a countertrend rally after the Fed meeting. As such, the recent price action isnt particularly newsworthy. I wrote:

With the next Fed meeting scheduled for Dec. 14/15, more hawkish rhetoric/policy should materialize. And with investors prone to buy the rumor and sell the news, gold may suffer in the lead up to the event. Thereafter, a relief rally may follow once the news is known. However, this scenario is in perfect tune with the 2013 analogy and doesnt change the bearish medium-term outlook. The bottom line? A profound drawdown of gold should materialize over the next few months.

Yesterday , I added:

Given how far the USD Index declined from its very recent high, the above means that the USD Index would be likely to decline by not more than it had already declined recently.

Well, gold moved visibly higher from the recent lows, but:

Please see below:

For more context, I wrote on Sep. 27:

In fact, gold miners weakness suggests exactly that.

Please see below:

Read Also: War Thunder Golden Eagles Code

Gold Slips 1% As Solid Jobs Data Spurs Rate Hike Bets

– Gold prices fell on Friday, pressured by a stronger dollar and as better-than-expected U.S. jobs data raised concerns of aggressive monetary policy tightening.

Spot gold fell 1% to $1,848.67 per ounce by 1759 GMT, after earlier falling to $1,846.4. U.S. gold futures settled down 1.1% at $1,850.2.

Data showed U.S. employers hired more workers than expected in May and maintained a fairly strong pace of wage increases, signs of labor market strength.

“If the Federal Reserve sees the economy continuing to remain stable in the midst of its rate raising efforts, they might feel more emboldened to raise rates at a faster pace,” said David Meger, director of metals trading at High Ridge Futures.

Higher U.S. interest rates increase the opportunity cost of holding gold, which bears no interest, while boosting the dollar in which bullion is priced.

Cleveland Federal Reserve Bank President Loretta Mester said on Friday she was looking for “compelling” evidence that inflation has peaked, and if it hasn’t, September’s Fed meeting could see a 50 bps rate hike as well.

The dollar edged up 0.3%, while U.S. benchmark 10-year yields were close to the two-week high touched earlier in the session.

Gold prices were set to log a 0.3% dip for the week, despite the metal hitting its highest since May 9 at $1,873.79 earlier in the session.

The medium-term outlook for gold is positive, said Jigar Trivedi, a commodities analyst at Mumbai-based broker Anand Rathi Shares.

Despite Potential Rate Hikes Real Rates Remain Low

Gold may face similar dynamics in 2022 to those of last year, as competing forces support and curtail its performance. Near term, the gold price will likely react to real rates in response to the speed at which global central banks tighten monetary policy and their effectiveness in controlling inflation.

Yet, in our view:

- while rate hikes can create headwinds for gold, history shows their effect may be limited

- at the same time, elevated inflation and market pullbacks will likely sustain demand for gold as a hedge

- jewellery and central bank gold demand may provide additional longer-term support

Don’t Miss: War Thunder Free Golden Eagles Code

Higher Rates In 2021 Outweighed Inflation Risks

Gold finished the year approximately 4% lower, closing at US$1,806/oz.1 The gold price rallied into year-end on the heels of the rapidly spreading Omicron variant, likely prompting flight-to-quality flows, but it was not enough to offset H1 weakness.

Early in 2021, as newly developed vaccines were rolled out, investor optimism likely fuelled a reduction in portfolio hedges. This negatively impacted golds performance and resulted in gold ETF outflows. The rest of the year was a tug of war between competing forces. Uncertainty surrounding new variants, combined with increasing risks of persistently high inflation and a rebound in gold consumer demand, pushed gold forward. Conversely, rising interest rates and a stronger US dollar continued to create headwinds. However, dollar strength led to positive gold returns in some local currency terms, such as the euro and yen among others .

Our gold return attribution model corroborates this. Rising opportunity costs were one of the most important contributors to golds negative performance in Q1, and intermittently in H2, while rising risks especially those linked to elevated inflation pushed gold higher towards the end of the year .

Best Forecasters Compiled By Bloomberg See Drop In Gold Price

According to a Bloomberg news article dated October 17th, 2013, the most accurate analysts tracked by Bloomberg over the past two years predict that the price of gold will decline in each of the next four quarters and reach a four-year low as reduced U.S. stimulus in response to faster economic growth curbs demand for bullion as a safe haven.

According to the median of estimates from the 10 most-accurate precious metals forecasters, gold will drop to an average of $1,175 an ounce in the third quarter next year, a level at which prices were last in 2010.

The forecasts show the assumption of the analysts that some investors have lost faith in gold as a store of value as the decline in its price will result in the first annual loss in 13 years.

Desire to buy gold as a hedge against the consequences of monetary policy has diminished, said Tom Kendall, an analyst at Credit Suisse Group AG in London whose precious-metals forecasts were the second most-accurate over the past two years according to Bloomberg. He added when youve got other asset classes, equities in particular, doing so well, then its hard to divert investments out of them and into something like gold, which is falling.

| Time Frame |

|---|

Don’t Miss: Gold Brick Weight In Pounds

Goldman Sachs Analysts Expect Gold Price To Rise To Us$2500 By The End Of 2022

Analysts at the US investment bank Goldman Sachs are forecasting a sharp rise in the price of gold during this year. At the end of March, they predicted an increase to 2,300 US dollars per troy ounce on a three-month horizon and even a price of 2,500 US dollars on a six- and 12-month horizon.

The analysts cite the following reasons for their expectations:

| Scenario |

|---|

Silver Price Predictions Projections & 5

Jeff Clark, Senior Analyst, GoldSilver.com

What will the silver price do in 2021? And where is it headed over the next 5 years?

Ive compiled silver price predictions from a number of precious metals analysts and consultancies. I also make my own prediction, based on the key factors that in my experience are most likely to influence the silver price both this year and the next five years.

This will be fun, so lets jump in!

Read Also: How To Get Tinder Gold Free

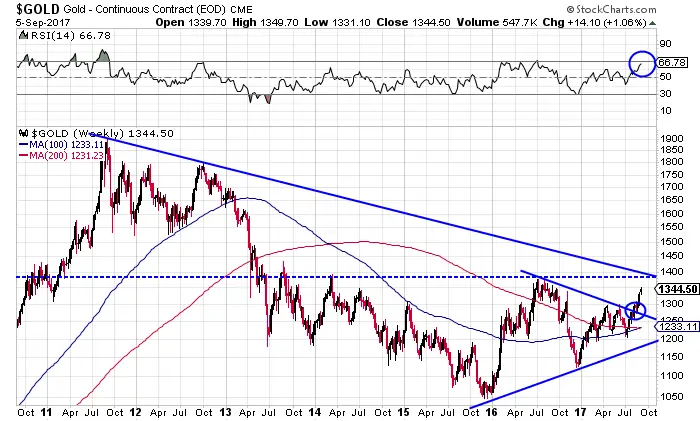

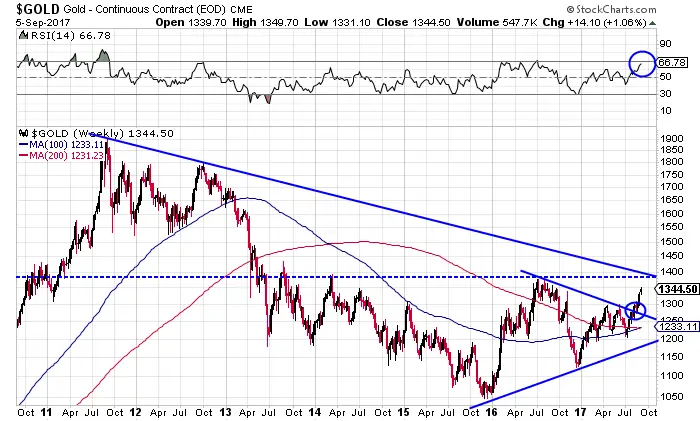

Rbc Capital Markets Makes Aggressive Gold Price Forecast For 2017 And 2018 Saying A New Bull Market Is Under Way

Citing strong investor demand, RBC Capital Markets, the Canadian investment bank which is part of the Royal Bank of Canada, is predicting a gold price of US$ 1,500 an ounce in 2017 and 2018. In its previous forecast, the bank still expected a considerably lower price of US$ 1,300 an ounce.

According to the bank, the ratio of daily net inflows into gold-backed ETFs versus outflows is about 8:1, showing strong investor demand. The banks analysts expect that strong investor demand to continue due to higher geopolitical uncertainty and higher systemic risk associated with declining real interest rates. In a note to investors, they voice their believe that the economic environment is more favourable for gold with a dovish outlook by the US Fed, declining real rates, global central bankers looking to negative real rates for economic stimulus and steady fundamental demand for physical gold.

According to the analysts, investors see gold as a store of value and a hedge against negative real interest rates. In their view, global bond markets and negative real and nominal interest rates are having the biggest impact on gold prices, with more than $10 trillion in global sovereign debt now yielding negative returns.

For 2020, the analysts expect the gold price to come down again to US$ 1,300.

| Time Frame |

|---|

Gold In The Age Of High

The best thing you can do is know how to have a balanced portfolio.Ray Dalio, Bridgewater Associates

In an article headlined Robots conquered stock markets/Now theyre coming for bonds and currencies, Bloomberg finance reporter Lananh Nguyen tells us: In the most liquid equity markets, more than 90 percent of trades are executed electronically, according to estimates from Greenwich Associates. That compares with 79 percent in global foreign exchange, 44 percent in U.S. Treasuries and 26 percent in U.S. corporate bonds, with the most room for growth in the latter two markets, according to McPartland at Greenwich. Just this year, Morgan Stanley and Goldman Sachs requested counterparties forgive rogue, machine-driven trades that caused a $41 billion flash crash in a matter of seconds. Though concentrated in a single stock, such anomalous events serve as a cautionary tale on how a full-out, machine-driven panic might evolve on a larger scale.

Ready to include a safe haven in your portfolio plan?DISCOVER THE USAGOLD DIFFERENCE

USAGOLD note: Blain becomes introspective in the run-up to the holidays. Chasing value is his theme

Gold knocking once again on $1800s door, silver looking revitalizedHamilton: Delayed secular gold bull should be resuming

Chart of the Day

Gold and silver price performanceChart courtesy of TradingView.com

Read Also: How To Get Tinder Gold Free Trial

Goldman Sachs Raises Gold Price Forecast For The Next 12 Months From Usd 2000 To Usd 2300

According to a team of analysts at Goldman Sachs, the global investment bank, the rise in the price of gold to new highs, which lately has outpaced gains in real interest rates and other alternatives to the US dollar, has been driven by a potential shift in the U.S. Fed toward an inflationary bias against a backdrop of rising geopolitical tensions, elevated U.S. domestic political and social uncertainty, and a growing second wave of COVID-19 related infections.

According to the analysts, combined with a record level of debt accumulation by the US government, real concerns have been raised about the longevity of the US dollar as a reserve currency.

Another point made by the analysts led by Jeffrey Currie is that hedges against inflation, such as commodities and equities, are probably much cheaper at the moment than they might be in the future, when inflation might be on the horizon. The current devaluation which is lowering the value of currencies and the accumulation of debt sows the seeds for future inflationary risks despite inflationary risks remaining low today.

| Time Frame |

|---|

Societe Generale Sees A Gold Price Bubble

SocGen lowered its gold price forecasts. The predicted gold price for 2013 was lowered from USD 1,700.- to 1,500.- and the estimated price for 2014 was cut from USD 1,600 to USD 1,400.

Societe Generale assumes that a gold price bubble has developed over the last years, which will be followed by a bear market. The authors of the review note cite a recovering US economy, which will lead to decreasing stimulus measures, as well as increasing interest rates but furthermore low inflation rates as reasons for their predictions.

| Time Frame |

|---|

Don’t Miss: Charter Gold Package Cost

Gold Price Per Gram Today

Actual Gold Price equal to 57.53 Dollars per 1 gram. Today’s range: 57.50-57.61. Previous day close: 57.51. Change for today +0.02, +0.03%.

| 57.53 |

| 28.7% |

Gold Price forecast for .In the beginning price at 57.28 Dollars. High price 61.22, low 55.39. The average for the month 58.05. The Gold Price forecast at the end of the month 58.30, change for December 1.8%.

Gold Price forecast for .In the beginning price at 58.30 Dollars. High price 61.89, low 55.99. The average for the month 58.78. The Gold Price forecast at the end of the month 58.94, change for January 1.1%.

Gold Price forecast for .In the beginning price at 58.94 Dollars. High price 61.45, low 55.59. The average for the month 58.63. The Gold Price forecast at the end of the month 58.52, change for February -0.7%.

Gold Price forecast for .In the beginning price at 58.52 Dollars. High price 62.72, low 56.74. The average for the month 59.43. The Gold Price forecast at the end of the month 59.73, change for March 2.1%.

Gold Price forecast for .In the beginning price at 59.73 Dollars. High price 60.81, low 55.01. The average for the month 58.37. The Gold Price forecast at the end of the month 57.91, change for April -3.0%.

Gold Price forecast for May 2022.In the beginning price at 57.91 Dollars. High price 60.83, low 55.03. The average for the month 57.93. The Gold Price forecast at the end of the month 57.93, change for May 0.0%.