What Kind Of Currency Does The Philippines Have

Gold Price Philippines. Like many other global currencies, the peso can be subdivided into 100 smaller units of currency called centimos. Because The Philippines is a former U.S. colony, it used English on its currency with the word peso appearing on its coins and banknotes until 1967. The term piso is now used,

Gold Prices Decline In The Domestic Markets

Gold rates declined in the domestic market on 7 April due to a mute trend seen in the international market due to optimism surrounding the U.S economy after the U.S. Federal Reserve meet.

On the Multi Commodity Exchange, gold contracts for June delivery was trading lower by 0.26% at Rs.45,798 per 10 grams. Silver futures for May delivery was down by 0.29% at Rs.65,705 per kg.

Gold prices had increased before due to the recent rise in COVID-19 cases all over the world and the U.S. dollar value declining in the market.

8 April 2021

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

Also Check: Does Kay Jewelers Sell Fake Jewelry

What Makes Gold A Precious Metal

This is a classification of specific metals that are considered rare and have a higher economic value compared to other metals. There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesnt corrode.

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

Don’t Miss: Kay Jewelers Sale 19.99

Gold Trades Lower In The Domestic Market A Negative Trend Was Seen In The International Market

In the Indian market, gold was trading lower due to muted trends seen in the international market. Silver prices followed suit and had declined by nearly 1%. On the Multi Commodity Exchange, gold contracts for April delivery were trading lower by 0.36% at Rs.44,788 per 10 grams. Silver futures for May delivery was trading lower by 0.75% at Rs.67,490 per kg.

The U.S. Treasury yields were near the 1.5% mark and both the precious metals recorded more than a 1% decline in the international market. Gold futures for April were at $1,715.80 per ounce and silver contracts for May were at $26.39 per ounce.

10 March 2021

Gold Price On 20 September 2021

On Monday, 20 September 2021 24 carat gold was selling for Rs.46,390 per 10 gram in India. Due to state taxes, excise duty, and making charges, the price of gold jewellery varies across India, the metal’s second-largest consumer. 10 gram of 22-carat gold was selling for Rs.45,550 in New Delhi and Rs.45,390 in Mumbai. The yellow metal was selling for Rs.43,710 in Chennai. The price of 10 grams of 24-carat gold in Delhi is Rs.49,690, whereas it is Rs.46,390 in Mumbai. Gold is selling for Rs.47,690 in Chennai this morning. The cost is Rs.48,350 in Kolkata.

20 September 2021

You May Like: Wow Classic Buy Gold Safe

Buying Gold For Investment

Although no investment is completely devoid of risks, gold is one of the few assets that come with no strings attached. It is a great way to diversify your portfolio because prices have historically grown with the passage of time. Many people see gold as a stable form of investment because prices continue to lurch ahead even though bonds, stocks, and the US currency come crashing down.

Trend Of Gold Rate In Bangalore For October 2020

| Parameters |

- Opening at Rs.5,202 per gram, gold price in Bangalore showed an overall inclining trend in the first week of the month. The price of the metal increased to Rs.5,211 per gram on 5 October.

- However, on the following day, the price of the metal dipped to Rs.5,174 per gram on 6 October and increased again to cross the Rs.5,200 per gram mark. On 9 October, gold was priced at Rs.5,171 per gram.

- On 10 October, the metals price crossed the mark yet again at Rs.5,208 per gram and increased to its highest at Rs.5,248 per gram, closing at the same price on 11 October.

- Gold price in Bangalore at the start of the third week of October was Rs.5,249 per gram. When compared to the price charged on the final day of the previous week, gold rate in the city was up by Re.1 for every gram.

- Gold recorded its highest price for the month till date on 13th October when a gram was retailed for Rs.5,254. The price of gold slipped in the city over the next few days and was retailed for Rs.5,192 per gram on 15th October.

- The price of gold improved slightly and closed the week at Rs.5,221 per gram. Golds overall performance witnessed an inclining trend in the rates.

Don’t Miss: Is The Delta Platinum Card Metal

How Many Grams In An Ounce Of Gold

Precious metals, including gold are measured in Troy Ounces. There are 31.103 grams in a Troy Ounce of gold.

Gold is not measured in the typical Ounce. Precious metals, gold included, are measured in what is known as a Troy Ounce.

Although many measurements from the beginning of the metric system have adapted to adjustments and changes, the Troy Ounce remains a standard measurement among those in the gold trade. When you hear or see descriptions of ounces in relation to gold, you can assume that it is the Troy Ounce and not a standard Ounce that is being used.

The Troy Ounce is used as a standard measurement that is shared among anyone that deals with the purchasing and manufacture of anything related to gold. The Troy Ounce is part of a larger measurement system for precious metals that is known as Troy weights. A regular Ounce is comprised of 28.35 grams. A Troy Ounce, however, is comprised of 31.1034807 grams. As you can see, there isnt much of an overall difference between the two types of Ounces, but when it comes to gold weight, that extra 2 or 3 grams affects the size of the finished product. If you were to compare a piece of jewellery, like a ring, that weighed a standard Ounce and one that weighed a Troy Ounce the latter ring would be slightly bigger or thicker.

1

2

Divide the price per troy ounce by 31.1 to convert the price to U.S. dollars per gram. In the example above, divide $1,400 by 31.1 to get $45.02 per gram.

3

4

References

What Are Spdr Gold Shares

SPDR Gold Shares, short for GLD, is the largest gold-backed exchange-traded fund in the world. It is marketed and managed by the State Street Global Advisors. The market cap for GLD is $32.44 billion as of March 2019. The exchange-traded fund was first launched in November 2004. It originally appeared on the New York Stock Exchange under the name streetTRACKS Gold Shares.

This name was changed to SPDR Gold Shares later in May 2008. It trades on the NYSE Arca. GLD also trades on the Singapore Stock Exchange, Hong Kong Stock Exchange and the Tokyo Stock Exchange.

You May Like: How To Get Golden Eagles War Thunder

Gold As An Investment

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

How To Buy Gold

First, decide what kind of Gold youre interested in buying. There are several types of Gold, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Gold bullion, choose between Gold coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Gold. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Gold in their own vaults or lockboxes at home, as well.

Also Check: Banned For Buying Gold Wow Classic

Ct / K Gold Price Per Gram :

9K gold contains the least amount of gold compared to other forms. It has only 37.50% pure gold and 62.50% other metals. The other metals could be silver, zinc, or platinum, etc.

375 hallmarked gold is comparatively harder, but that does not mean that it is more durable. Its harder material makes it less durable, so you need to keep that in mind before buying it.

Trend Of Gold Rate In Bangalore For November 2020

| Parameters |

- In Bangalore, the price of gold on 1 November was Rs.5,194 per gram and increased marginally to Rs.5,195 per gram on 2 November. However, the price of the metal fluctuated due to global trends.

- On 3 November, gold rate in Bangalore dipped marginally to Rs.5,193 per gram and increased marginally to Rs.5,194 per gram on 6 November due to uncertainty surrounding the U.S. elections.

- The price of the metal increased on 7 November at Rs.5,237 per gram and increased to hit the weekly high on 8 November at Rs.5,281 per gram and closed the week at the same rate.

- Gold rate in Bangalore was Rs.5,282 per gram on 9th November. When compared to the closing price of the previous week, the price of the precious metal witnessed an increase of Re.1

- Gold recorded its highest price for the month till date on 10th November when a gram was retailed for Rs.5,302. The price of the yellow metal slipped in the city the next day and recorded its lowest with a gram costing Rs.5,139.

- The price of gold recovered gradually and closed the week at Rs.5,205 per gram. Golds overall performance witnessed an inclining trend in Bangalore.

Recommended Reading: War Thunder Hack No Survey

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

You May Like: Does Icebox Sell Fake Diamonds

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

Also Check: Ultra Pure Gold Alcohol Content

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

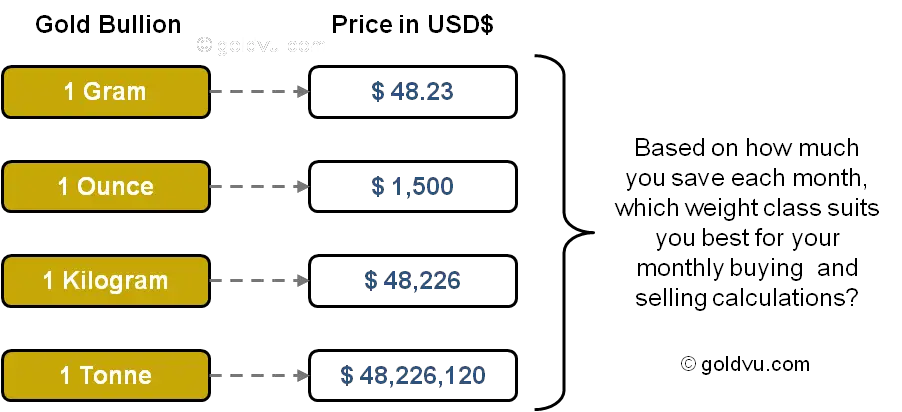

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

Is The Gold Price The Same As The Spot Price

When looking at gold prices, the figures quoted are typically going to be spot gold prices unless otherwise specified. The spot gold price refers to the price of gold for delivery right now as opposed to some date in the future. Spot gold prices are derived from exchange-traded futures contracts such as those that trade on the COMEX Exchange. The nearest month contract with the most trading volume is used to determine the spot gold price.

Recommended Reading: Golden State Grant For Ssi Recipients