Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

How Often Do Gold Spot Prices Change

Spot prices for gold are constantly changing, as can be seen on any gold price chart. The price floats freely on the market and responds to real-time trading behavior.

U.S. markets close at 5:15 pm in New York, but gold continues to trade âovernightâ in Asian and Australian markets. Today’s gold price is rarely the same as yesterday or tomorrow. Therefore the spot price can change at virtually any time.

Historical charts before about 1950 don’t reflect this. Reliable data about the historical gold price is harder to find. Gold prices today are more dynamic and well-documented.

Recommended Reading: 18 Karat Gold Prices

What Is Gold Price Per Kilo

Where a gram is a nice smaller weight to purchase gold bullion, the kilogram is larger, just as desirable and somewhat unique. One kilogram is equal to 1000 grams which is approximately 32.15 troy ounces. If you are looking to buy a larger size and amount of gold, buying a gold bar or coin in kilos is a good option. The kilogram is known worldwide as a popular way to purchase a good amount of gold at once.

Why Should I Invest In Gold

With a rich history amongst almost all global cultures, gold remains a highly popular investment. Although it has multiple uses, its primary function is typically to hedge against inflation in an often volatile futures market, as well as to diversify existing Precious Metals Investment Retirement Accounts.

Gold has been one of the most valuable precious metals throughout human history, used by elites as a symbol of wealth for centuries due to its rarity and its ability to hold its worth for a long time. Historically, it has been the most common way to pass on ones wealth as an inheritance from one generation to the next.

Gold is considered a worthy investment, with coins and bars available for purchase in various sizes, ranging from one gram to a whopping 400 ounces. At Bullion Exchanges, we carry a wide selection of gold products to suit the likes of both savvy investors and passionate collectors.

Being the most reliable investment commodity available, gold has proven to be a perfect way to diversify your investment portfolio and an excellent safeguard against volatile currency.

Also Check: War Thunder Hack No Survey

> > > Get Your Free Gold Investor Kit Here

An individual retirement account is one of several types of IRAs. This type of IRA allows you to invest in bonds, stocks, and other assets, instead of having to invest in mutual funds and other products. A good gold IRA has a lower cost of investment than a standard or Roth IRA which invests solely in bonds, stocks, and mutual funds. However, there are differences between a standard and a hedge against inflationary climate.

There are several types of IRAs that an individual can open for investing. The most common IRA types include a standard IRA, a hedge against inflation, and a gold IRA. If you want to have the most flexibility with your investments, then you should invest in a standard IRA. To learn more about these different IRAs, as well as the pros and cons, we have looked at some of the more popular options.

How Are The Premiums Over Spot Calculated Are They The Same For All Gold Products

Premiums vary depending on the product.

Generic gold items usually have lower premiums. A more intricate design on a gold bar or gold coin will raise the premium. Rare or limited edition products will also have high premiums.

The reason for this is twofold. Highly artistic gold products are more costly to manufacture. Buyers are also willing to pay more for such items.

Recommended Reading: What Is 14k Italian Gold Worth

Is Physical Gold Taxed

Any purchase of physical gold bullion is subject to the sales tax of the state where the buyer is located. Local and municipal taxes may also apply.

If the order is over $500, any applicable sales taxes are waived in Florida. Any U.S. legal tender gold coins are also exempt from sales taxes within the United States.

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

Don’t Miss: War Thunder Golden Eagles Free

What Is The Gold Rate In Pakistan

Today Gold rate in Pakistan is Rs. 77,100 per 10 grams, and Rs. 89,900 per tola . The rates are normally same all over Pakistan, however every city Sarafa market decides the current gold rate. The Gold Rates in all major cities of Pakistan, including Karachi, Lahore, Peshawar and Islamabad are given below.

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Don’t Miss: Carats Of Gold Explained

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

How Is The Gold Per Ounce Price Determined

Gold is a leading globally bartered asset that is traded on numerous futures markets. The most renowned and recognized exchanges include the New York Mercantile Exchange, the Chicago Mercantile Exchange, the Hong Kong Mercantile Exchange, Zurich, and London. COMEX is the essential business sector for exchanging metals, such as gold, silver, copper, and platinum. Once known as the Commodity Exchange Inc., COMEX converged with the New York Mercantile Exchange in the early 1900s and was designated as the primary division responsible for the precious metal exchange, including but not limited to the designation of the spot price of gold.

When determining the spot price of gold, it is important to note that the calculation is based on the front-month futures contract which is traded on the COMEX. The term front-month is utilized in futures trading in reference to the contract month with an expiration date nearest to the present date, which is usually around the same time.

Approximately 31.1035 grams of 24 karat pure gold makes up a troy ounce, while a kilogram consists of 32.15 troy ounces. The gold spot price per ounce is influenced by various factors, including these major ones:

Read Also: One Oz Of Gold In Grams

What Is Paper Gold

âPaper goldâ is the nickname for investment products that track the price of gold. This primarily means gold ETFs and futures.

The distinction between physical gold and paper gold is the latter is only âon paper.â By contrast, physical gold is a tangible asset.

Physical precious metals change hands in over-the-counter markets. The best example is the London Bullion Market, the UK gold hub.

Gold Bars For Trading And Investment

Large gold bars are held as gold reserves by central banks and wealthy investors. Gold bars are produced at a refinery or mint. They are measured in troy ounces. The 400-troy ounce bar is the standard unit which is commonly traded among bullion dealers in the West. These gold bars are 438.9 ovidparous ounces. The most manageable large gold bar for trading and investment is the kilobar which is the most common size in the East. A kilo weighs 32.15 troy ounces, which is equivalent 1000 grams. It is ideal for the smaller transfers made between banks and traders. While most of these kilobars are flat, some come in a brick shape.

Recommended Reading: Delta Skymiles Metal Card

K Gold Price Per Gram

The current 24k gold price per gram is $58.01. This price is live and this page updates every 30 minutes with the most recent gold price. Bookmark this page and come back whenever you need to know the price of a single g of 24 karat gold. When it comes to quality nothing is better than 24 karat. Its the creme de la creme of gold jewelry. at 99.99% pure its as good as it gets.

If you want to figure out the price of any other gold purity or some other weight of 24k use out Scrap Gold Calculator now!

How Are Spot Prices For Gold Calculated

The total supply and demand for gold in the market ultimately determine the spot price.

Thus, movement of the spot price reflects a change in the available supply or current demand for gold. This includes factors such as:

- output from gold mines

- economic uncertainty

- other geopolitical events

Trading of gold futures has the most significant effect on today’s spot prices. The same is true for all commodities. So the silver price and platinum price behave in a similar manner.

General gold news can also influence investment demand for the precious metals. This includes gold, silver, platinum, and palladium.

For instance, prices today tend to shift dramatically if the Fed cuts rates. There may be a gold price rally if the International Monetary Fund adds to its gold reserves.

Learn more about gold futures contracts by following this link.

Recommended Reading: How To Watch Nbc Sports Gold

What Is The Gold/silver Ratio

It is the number of ounces of silver required to buy one ounce of gold. Silver and gold price chart history and the fluctuating gold/silver ratio is often used by investors to analyze how much silver is worth in comparison to gold, to evaluate if one of the two is overpriced at any given time. This enables investors to determine whether it is a favorable time or not for either buying or selling one of these commodities.

What Are Gold Futures Contracts

Futures contracts are agreements to buy or sell a commodity or asset at a future date. The amount being exchanged and the price are specified in the contract.

There are two main uses for gold futures contracts. They allow gold miners and dealers to hedge against falling prices. Futures also allow investors and large institutions to speculate on the gold price.

Don’t Miss: 5 Grams Of Gold Price

The Size And Shape Of Precious Metals

Precious metals such as silver, copper, platinum, and gold come in various forms. The most common ones are rounds, coins, and bars. Investors can buy gold certificates and notes, which are claims on gold held by the owner. Another riskier proxy for gold ownership is holding shares of precious metals ETFs. Physical gold can also be held inside a precious metals IRA.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

You May Like: Banned For Buying Gold Classic Wow

The High Appeal Of 20 Gram Gold Bars

Many investors buy gold 20 gram bars as part of a diverse investment portfolio. Two of the most respected mints in the world are Australia’s Perth Mint and Switzerland’s PAMP Suisse Gold. While they are many miles apart, both produce high-quality gold bars for investment purposes. Discover why 20 gram gold bars are reputable and highly trusted in the precious metals community.

What Are Bid And Ask Prices

The Ask price is the lowest gold price which a dealer agrees to when selling gold to a buyer. The Bid price is the highest price which a dealer agrees to pay when buying from an investor who is selling gold in the market. In other words, if you intend to buy gold from a dealer, you will pay the ask price, but if you wish to sell your previously purchased gold to the dealer, you will pay the bid price. The difference between Bid and Ask prices is referred to as bid-ask spread, or simply, the spread.

You May Like: 5 Grams Gold Value

Is Gold Traded 24 Hours A Day

Yes. Gold trades on exchanges located around the world. Even when one exchange is closed for the night, there is another somewhere else that is active.

Electronic trading of gold goes on continuously. This is reflected in the Globex gold price overseen by the CME Group. Globex prices are updated moment to moment based on futures trading.

24-hour gold trading means that gold product prices always fluctuate.

Vs 999 Gold: What Is Fine Gold

Before Tackling 9999 vs 999 Gold, Let’s Understand How it’s Measured

There are two common ways of measuring the fineness of gold, the millesimal fineness scale and the karat measure. The karat measure is in-fact used only for gold . In this article, I elaborate on these two scales. I discuss what pure gold actually is and when 9999 vs 999 gold makes sense from a buyer’s perspective.

Millesimal Fineness vs. Karat

Breaking Down Gold Fineness

999 vs. 9999 Fine Gold is All About Refining

Refining 9999 vs 999 Gold: a Similar Story

Fact: there are really only two truly accurate ways that businesses can verify the fineness of gold they purchase. The first, naturally, is to melt it down and assay the metal. This is a somewhat costly process yielding a highly accurate result. The “fire assay” as it is known in the industry is considered the most reliable method for accurately determining the content of gold in a “lot.” It also works for silver and platinum-group metals . The second is to use an X-ray fluorescence device that can also be used on the unmeleted product. In this case it only measures the outermost portion of the metal, but it does so relativly precisely. This machine has become a key component of most gold processing facilities . The beauty of the XRF machine is that the concentration of gold can be determined somewhat near to a fire assay. Yet, it only takes a fraction of the time .

Also Check: 18 Kt Gold Price

What Can Cause The Spot Gold Price To Change

Any change or disruption to either the supply or demand for gold will move the spot price.

If a large gold deposit is discovered, the increased supply will cause the spot price to fall. The reverse is true if the gold supply decreases.

An increase in gold demand will also drive the spot price higher. Perhaps the demand is due to accelerating inflation or extreme economic uncertainty.

Supply and demand are affected on a daily basis, meaning the gold spot price is constantly in flux.

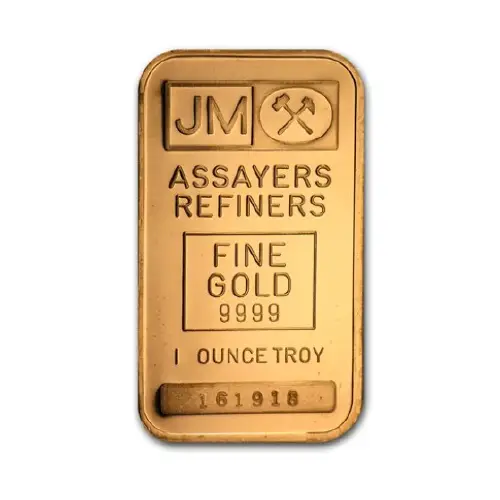

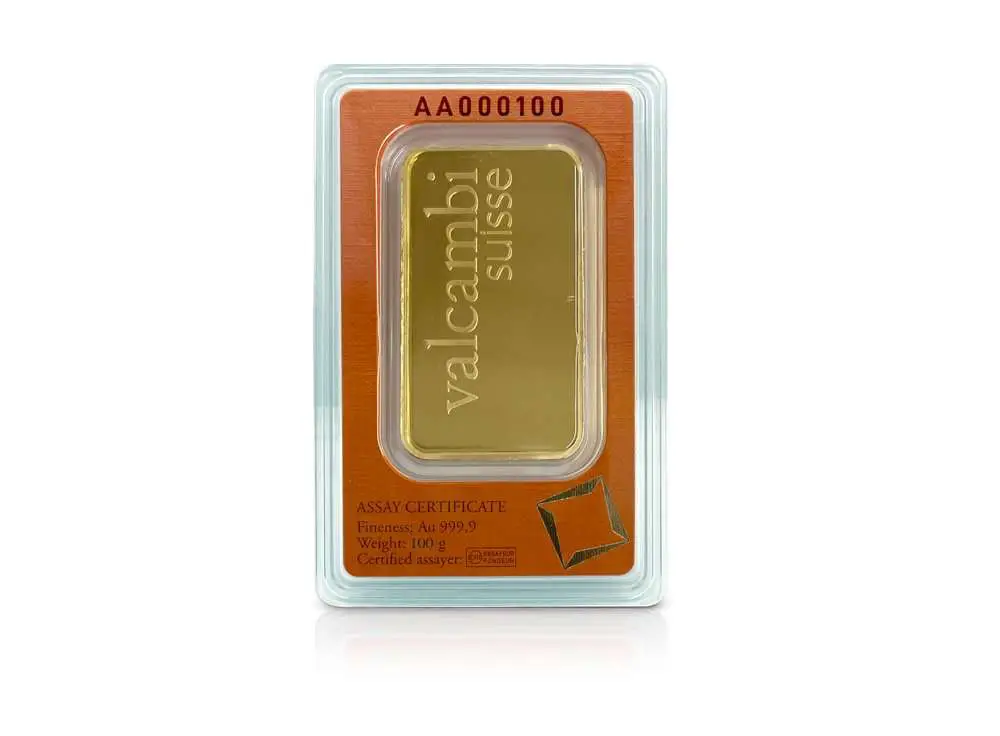

About The 1 Oz Gold Bar:

Each 1 oz gold bar has a unique design depending on the hallmark. Most of the hallmarks include their logo, weight, purity, and a serial number of the bar on the obverse. The reverse side typically has the logo or design repeated diagonally. The PAMP Suisse bar is the only 1 oz gold bar that doesn’t follow this traditional look. Instead, this bar features the Lady Fortuna on the front and the weight, purity, and logo information on the back.

The 1 oz gold bar you will receive will be our choosing, based on the availability we have at the time of the order.

Recommended Reading: How To Buy A Brick Of Gold