What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Why Is Gold Mostly Quoted In Us Dollars

While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Given that the U.S. is the worlds biggest economy and one of the most stable, the dollar has become a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Reserve currencies are used to settle international transactions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

Policies Of Central Banks

Central banks the world over implement policies that will either impact gold pricing positively or negatively. Below are some of them.

Change in Interest Rates

Central banks such as the Federal Reserve and many others can at times increase interest rates in an attempt to curb inflation. When interest rates increase, commercial banks will borrow less from the Federal Reserve and thus will not have a lot to lend to the general public. This will reduce money supply in the economy and decrease interest rates on investments such as treasury bonds, thereby encouraging investors to buy gold with a favorable opportunity cost. If the government decreases interest rates, the contrary will be the outcome.

Quantitative Easing

In QE, the Federal Reserve tries to increase the money held by commercial banks by buying securities. Thus, commercial banks will have more to lend to customers and the result will be an increase in money supply to the public. This will drive down interest rates, which will increase demand for gold as an alternative investment therefore leading to an increase in gold bar prices.

Gold Reserves

Ever wondered why central banks the world over hold reserves of gold? Well, they hold gold as a backup to printed currency. When central banks such as the Federal Reserve buy gold in large quantities for the reserves, they increase money supply while diminishing the quantities of gold available in the market. This will drive gold prices up.

You May Like: Does Kay Jewelers Sell Real Gold

Find The Actual Gold Weight Of Your Gold Coins

If youve heard the expression 14- or 24-karat gold, you may know the difference in consistency and quality of gold. When you sell gold, you sell it by its purity as well as its weight, and the closer a coin gets to 100% gold, the higher its value. If youre wondering how to sell gold coins, start with the actual gold weight , which is simply the raw weight multiplied by the purity. Its easy to weigh a coin , though a gold dealer will use a much more refined scale for the exact weight of the coin and its purity. Finding the purity, on the other hand, requires a bit more research. Check out online databases of coin values and purities and search by year, mint mark, and style of the coin.

Sell Your Gold Sovereign

If youre considering selling a gold Sovereign, we will be more than happy to purchase it from you. Please see our selling gold Sovereigns page for more information. If you own a gold Sovereign and want to get an idea as to how rare it is, try out our easy-to-use wizard. Simply enter its year in the box at the top of this page to get started.Notes:

See our article Gold Sovereign Value by Currency for up-to-date bullion valuations in 13 currencies.

Also Check: Does Kay Jewelers Sell Real Gold

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

Also Check: 1/10 Ounce To Grams

What Makes Gold A Precious Metal

This is a classification of specific metals that are considered rare and have a higher economic value compared to other metals. There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesnt corrode.

Find The Red Book Price

Similar to the blue book, the red book helps when selling gold coins by providing information on individual coins rather than the wholesale price: if you find a coin listed for $100 in the red book but on sale for $10, its a great deal. By contrast, a coin listed for $15 in the red book but on sale for $10 may just be the dealer trying to clear out inventory. The red book helps to determine insurance premiums for very rare or valuable coins by calculating the specific price for one coin.

Don’t Miss: One Brick Of Gold

Today Gold Price Jewellery Calculator

Welcome to the Gold Jewelry Price Calculator. Here, you can calculate the jewelry price using any karat , any unit type and any currency of the world . The current Gold jewelry price is being provided in the local time zone of the desired currency. To view and calculate the price of Gold , select a unit , then enter jewelry making cost .Similarly, enter a tax amount in percentage and then select your desired currency, then enter quantity, and click on the calculate button. All the calculation is based on the real-time live rates, which is given above. A calculator is an essential tool for Gold buyers and sellers, e.g., Goldsmiths. It is being used to estimate the worth of Gold Products

Find The Current Price Of Gold

If you happened to be lucky enough to buy gold before its spike in value during the 1970s, youd be sitting on a mint right now, as the value of the precious metal has increased to over thirty times its original value in a single generation. When looking at a gold coin collection, you know right away that regardless of the individual value of any coins, each one is worth at minimum the current price of the metal. You can keep up with the raw cost of your gold per ounce simply by Googling price of gold to get up-to-the-minute information on the commoditys dollar value. Theres a difference between the price of gold and the selling price, of course one is how much it costs to buy, the other is how much you can expect when selling gold coins and a local coin dealer will help you understand your collections value and how to sell gold. Remember that a coin dealer will give you a quote, which is simply how much theyre willing to pay.

Read Also: Does Kay Jewelers Sell Real Gold

Bullion Value Vs Numismatic Value

Answering the question is however not quite so straightforward as it seems. On a simple level, many Sovereigns are worth their bullion value. However, other Sovereigns have a higher, numismatic value. The value of a Sovereign is dependent on a number of factors.

- The year it was minted

- Which branch mint produced it

- The total number of Sovereigns produced at that mint for that year or the total number remaining

- Whether it was a bullion or proof issue coin

- The condition of the coin.

To give you an example, there are 7 versions of the 1887 Sovereign:

So, the Melbourne mint, young head shield Sovereign is far more scarce than a Melbourne mint, young head St. George Sovereign. Referring to the 2014 edition of Coins of England by Spink, a valuation of £900 is given for the former in fine condition . Compare this to the latter, being a far more common example, its value is in its gold content .

Detail Of Gold Jewelry Price Calculator

The process is described in the following image:1. Select a unit or weight. For example, gram, ounce, tola, etc 2. Enter the total number of units or weights, e.g., 1, 2, 3, 1.5, 2.5, etc3. Enter the cost of making that jewelry4. Cost of making jewelry can be in a percentage or an exact amount 5. Enter the amount of tax on both 6. Select purity or karat of gold 7. Select your desired currency like EUR, USD, INR, AUD, NZD, QAR, KWD, SAR, PKR, etc8. Click on the calculate button9. You see the calculated rate as shown in the image

Also Check: How To Get Free Gold Bars In Candy Crush

When Is The Gold Price The Strongest

It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement however, historically, there have been high and low seasonal period in the gold market. Historically, September is golds strongest month. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year. The worst month has historically been March, April and then June.

The Real Value Of Gold In The Ground

This is the second in a series of musings and accompanying videos with Vancouver-based Cipher Research Ltd, which evaluates exploration and mining companies for investment. Once again, we assess a segment of the gold resource sector.

Our first musing was posted in early February and titled The Real Cost of Mining Gold. It evaluated seven major gold miners over the 11-year bull market from 2003-2013, showed how and why they failed to profit and reward shareholders, and provided a solution for the future, i.e., a value versus growth philosophy. Three short videos on the subject can be accessed here: Mercenary GeologistVideos.

Today, our subject is the value of an ounce of gold in the ground.

Venture always flows where potential reward is perceived to have the lowest risk. In my opinion, advanced explorers and developers often offer the best risk/reward profile in the junior resource market.

There is a plethora of companies to choose from in all segments of the resource sector. For any speculator, the challenge is to separate the many pretenders from the very few contenders. This is an especially daunting task for the retail lay investor. In this musing, we provide insights based on decades of experience evaluating companies and their projects.

All junior resource companies can be evaluated and ranked utilizing four key criteria:

- Working capital: should have significant cash on hand and/or the ability to raise funds without severe dilution.

You May Like: 1 Oz Gold Equals How Many Grams

Calculating How Much A Gold Sovereign Is Worth

Putting the numismatic value to one side, at very minimum, a gold Sovereign is worth its weight in gold, otherwise referred to as its bullion value. If its in relatively unworn condition, it should still weigh 7.98g or thereabouts. A Sovereign is minted in 22ct gold, which means it contains 91.67% pure gold . To work out the bullion value of a Sovereign, we need to do some simple calculations. Pure gold is currently trading at around £1,360.78 / troy ounce .

There are 31.103 grams in a troy ounce, so to convert troy ounces to grams, we need to divide by 31.103. Therefore, the value of 1 gram of pure gold is £43.75 / g .

We already know that a Sovereign contains 7.31g, therefore the bullion value of a gold Sovereign is currently 7.31 x 43.75 = £320.08 .

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Don’t Miss: Where To Sell Gold Rdr2

Why Should You Consider Investing In Gold Bars

Why not? Gold has stood the test of time as a stable form of investment. It has enabled investors to safeguard their wealth for centuries and therefore investing in gold is indeed a wise decision.

Perhaps the most satisfying benefit of holding physical gold is that you get the chance to have total control over your wealth, unlike having your investments in a banks savings account.

As you might know, the future of the dollar is uncertain and therefore converting a portion of your wealth to gold will certainly protect you against future risks.

Gold will therefore enable you to crash-proof your retirement and give you some sense of security.

If you considering rolling over your IRA or 401k to gold or silver, you can check out our top-rated Gold IRA Company Here> > .

Now, lets dive in and explore the common factors that affect the price of a gold bar.

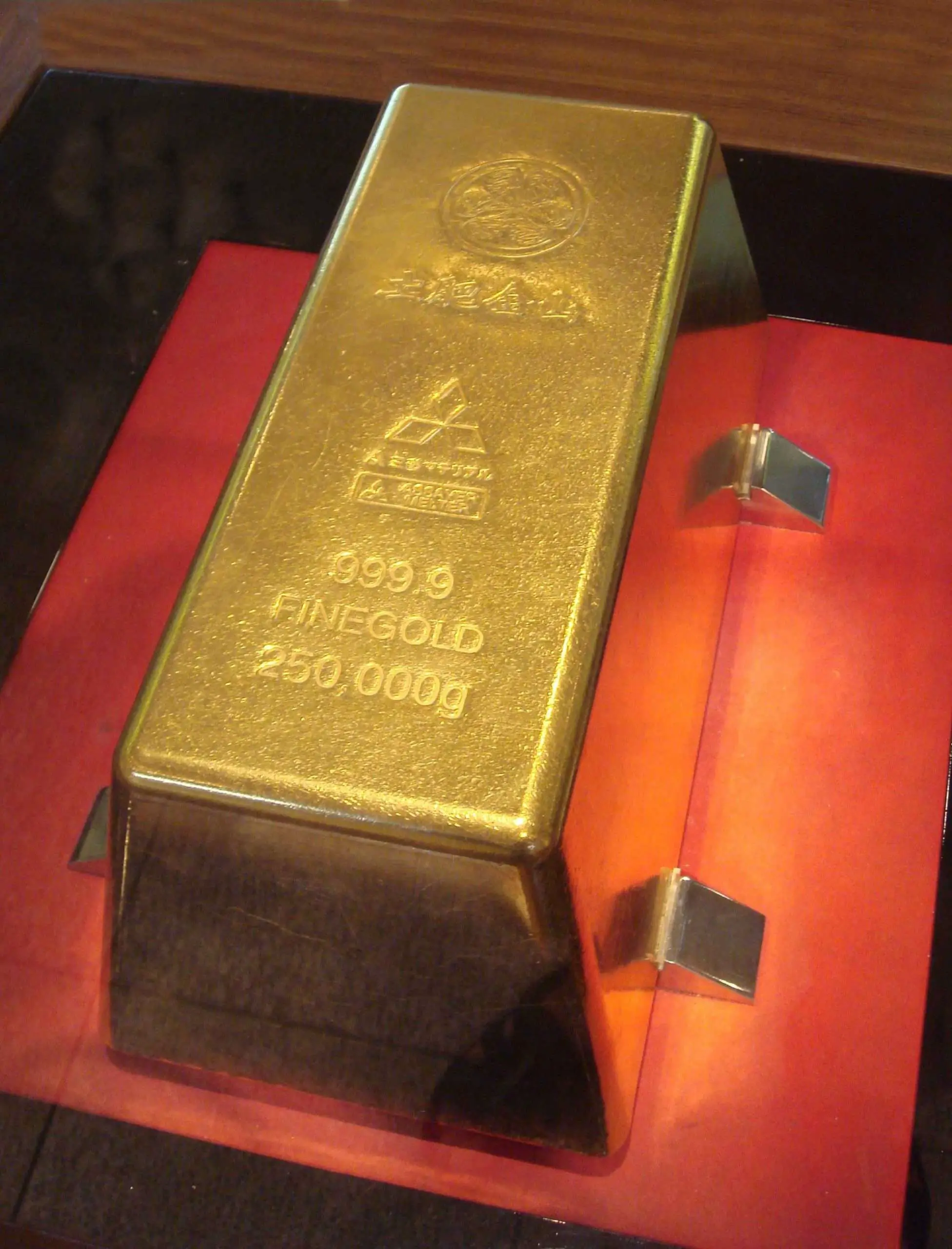

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

You May Like: Permanent Gold Teeth St Louis

How Much Is The Largest Gold Bar In The World Worth

According to the Guinness Book of World Records, the largest gold bar is owned by Mitsubishi Materials Corporations. Its dimensions are 17.9 inches by 8.9 inches by 6.7 inches and weighs 551 pounds. Its current estimated worth is over $10 million. While its weight may seem too heavy, its size is too small to fit in a shoebox and therefore is less bulky and can be stored or transported easily.

Learn the right way to buy gold or silver. Get our Free Precious Metals Investment Kit Now!

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

Also Check: How Many Grams Is 1 10 Oz Of Gold

How Much Gold Has Been Mined

The best estimates currently available suggest that around 197,576 tonnes of gold has been mined throughout history, of which around two-thirds has been mined since 1950. And since gold is virtually indestructible, this means that almost all of this metal is still around in one form or another. If every single ounce of this gold were placed next to each other, the resulting cube of pure gold would only measure around 21 metres on each side.

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Read Also: How Many Grams Is 1 10 Oz Of Gold