Q: How Much Money Do I Need To Buy Gold

A: This depends on a few different factors. The type of gold investment youre making, the quantity, and your method of payment all factor into the total cost for a gold purchase. You can actually buy fractional denominations of gold at an extremely low cost. Gold ETFs can also be purchased with relatively low upfront cost.

Gold Bar Price Vs Gold Coin Price Premiums

Premiums are an added cost to any gold transaction, which take into account four different fees: the live gold spot price, a gold fabrication fee, a gold distribution fee and the dealers gold premium fee.

When it comes to evaluating gold prices in coins, the numismatic value and/or collectible value of the gold coin must be accounted for. The numismatic value refers to the relative rarity of the coin. If the gold coin is deemed to be exceptionally rare, the premium will be higher, and thus, the price of your gold bullion purchase increases.

While it might surprise you that numismatic value on any gold coin is an added cost, keep in mind that you will increase ROI from this added cost when you choose to sell your gold in the future. The price of gold coins are increased by rarity, scarcity, quality of production, as well as demand for similar items.

Gold bars, on the other hand, have low numismatic value. The large slabs of gold are popular specifically for this reason and carry lower market gold prices.

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Don’t Miss: How To Get Free Golden Eagles In War Thunder

Are Spot Gold Prices The Same Everywhere

Gold is traded and used all over the world for investment purposes, jewelry making and as a medium of exchange. Because an ounce of gold is the same whether it is in the U.S. or in Japan, the spot gold price is theoretically the same everywhere. Of course, differing currency values can have an effect on gold as well, and dealer premiums can also vary. Using the spot price of gold, the yellow metal can be bought anywhere using any currency. For example, if the spot price of gold is $1100 per ounce and you were looking to buy gold in Japan, you could figure out the necessary currency conversion to buy gold using Japanese Yen. Gold is traded all over the world, and thus its price is always on the move. Some of the major hubs for gold trading include the U.S., London, Zurich, India and more. The spot gold market is essentially always open, as markets follow the sun. Keep in mind that gold is typically bought for a premium over spot and sold at a discount to spot.

What Is ‘spot Price’

Gold and silver are traded globally as commodities. Trading is done based on contracts for the future delivery of the precious metals. The spot price of gold or silver is the price that it is currently trading at based on the future delivery of the commodity contract. By being traded as futures on the COMEX market, most gold and silver is sold long before it is mined and refined into bullion products.

Silver and gold bullion dealers buy, sell and price their products based on the ask and buy spot prices.The spot price of gold refers to the price of one troy ounce of gold and the spot price of silver refers to the price of one troy ounce of silver.Gold and silver must be of specific fineness requirements

The ask spot price is what people, commodity traders and bullion dealers is the gold spot price that they will be selling at per ounce. The buy spot price is the price at which the same groups will be buying gold.

Also Check: Free Candy Crush Gold

How To Buy Gold At Spot Price

New gold bullion buyers often begin by wondering how they might be able to buy gold at spot as well where can you buy gold bullion at the spot price.

We begin first and foremost, with a word of caution. Please be careful in your buying gold bullion at spot price endeavors.

Many offers for gold at spot price or even for gold under spot price are often the realm of conmen, counterfeits, and dishonesty.

Here well teach you how to buy gold at or near spot safely via proper due diligence and knowing the counterparty is trusted and in fact, delivers on their word or promises.

Relationship Between Gold Coin Value And Gold Spot Price

Like all forms of gold, the price of gold coins will fluctuate depending on the gold spot price. When investing in gold coinage, be aware of the other factors that influence the gold price. The mintage, scarcity, numismatic value and condition of the gold coin itself are four secondary influencers that affect the gold price of any gold bullion product on the market.

Also Check: How To Get Free Golden Eagles In War Thunder

Sign Up For Our Silvergoldbullca Gold Price Alert Service

Looking to sign up for our gold spot price alerts service? SilverGoldBull.ca offers an intuitive tool to help notify you when your ideal gold price or silver price is current in the market. Sign up for our gold price alerts to never miss your ideal spot gold price target again! Take advantage of our useful gold prices notifications and secure a better ROI on your gold bullion investments by purchasing your gold at the best possible prices.

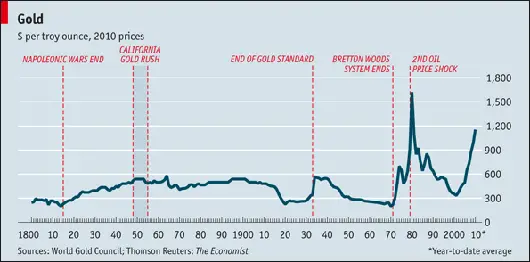

History Of Gold Spot Price

There is a solid historical reason why the bulk of the worlds physical trading of bullion is handled out of London. In 1933, President Roosevelt declared that it was no longer legal for Americans to privately own gold. Called the great Gold Confiscation, citizens were required to turn in all their gold currency and bullion for paper dollars. That meant most of the trading in physical gold moved from the U.S. to London. When the laws were changed back in the 1970s so that Americans could again buy gold and hold it, the gold market was simply too entrenched in the LBMA.

When investing in gold coins, you are buying a physical item with a gold price that is affected by the futures markets outside of normal supply and demand issues. This is because those future contracts can be settled with a payment of cash rather than physical quantities of gold. Another way of saying this is that when you buy gold coins at the current gold spot price, you are paying a price that actually represents that expectation of future value, rather than the actual momentary price of a physical trade. While that may not seem to be a major factor, it is important to understand that the price of gold will fluctuate more on the expectation of future prices than on current supply and demand.

You May Like: Why Are Golden Goose Sneakers Expensive

What Is Paper Gold

âPaper goldâ is the nickname for investment products that track the price of gold. This primarily means gold ETFs and futures.

The distinction between physical gold and paper gold is the latter is only âon paper.â By contrast, physical gold is a tangible asset.

Physical precious metals change hands in over-the-counter markets. The best example is the London Bullion Market, the UK gold hub.

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

Gold Coins Vs Gold Bars: How To Know Which To Invest In

Deciding on the type of gold you invest in depends on your current investment portfolio, and the amount of risk you are willing to accept. Investing in gold bars represents a relatively low-risk option with incremental long-term rewards. The gold price premiums are low and the option to sell is always available if the market continues to rise. If you want to diversify your portfolio with an investment like mutual funds or bonds, investing in gold bars is your best option.

Gold coins represent higher premium costs and a bit more risk, as the price of gold coinage tends to fluctuate more than gold bars. The upside to gold coins is that you can read the market effectively and sell them at a five or ten-year high in price. Additionally, gold coins have an added benefit as they allow selling in smaller batches. This makes it easy to sell smaller portions of your gold bullion as opposed to selling a single 1kg gold bar all at once.

Gold Bullion Barsdesign And Specifications

For centuries, buying physical gold has been recognized as one of the best ways to store wealth and preserve purchasing power. In addition to these well-established attributes, modern day investors continue to buy gold bullion bars for their portfolio diversification properties.Monex offers gold bars in three convenient forms. The 10 ounce gold bullion bar of at least .995 fine purity is the standard industry unit. Also available is the 32.15 troy ounce gold kilobar, a one kilogram bar of at least .999 fine gold purity. Both of these gold bars are hallmarked by a leading refiner to certify weight and purity and are available for personal delivery or storage.

For those who desire the finest investment-grade gold bullion bars available, we offer the exclusive Monex-certified 10 ounce gold bullion ingot. Composed of pure .9999 fine gold, this magnificent bar is one of the purest available to investors today. Each bars weight and purity is certified and guaranteed by Monex and is further hallmarked by Heraeus, a world-leading refiner, and the reputable Austrian Mint. Please note: Although this is our main gold bar offering, Monex may also offer larger gold bar sizes, including 400 ounce gold bars, by request.Gold bullion bars are real, tangible assets, and throughout history, have been an ideal store of value. They are extremely liquid investments, easily stored and transported, and can be a uniquely private way to preserve one’s wealth.

Also Check: Why Are Golden Goose Shoes So Expensive

What Is The Gold Price In My Currency

Since gold is priced in US dollars around the world, the spot price is the same everywhere at any given moment. However, investors in non-US countries can convert the US price to their local currency to reflect its value in that unit of currency. Even though the underlying spot price is the same, at any given time in local markets the premium above spot may vary, sometimes significantly.

There have been times where, due to changes in a currencys value, the gold price in another currency may rise or fall more than the US dollar priceor even move in the opposite direction. In 2014, for example, the gold price rose in all major currencies, except the US dollar.

What Does Determining The Spot Price Mean For Gold

Determining the spot price for gold doesnt mean you can purchase it for the amount, but it helps you project the market trends for golds value, providing long-term investment opportunities. After multiples months of any given year, you can see how the market fluctuates from contango to backwardation, helping you establish the right time to buy. In essence, the spot price doesnt directly affect the investor it affects the accumulation of market trends and fluctuations throughout a given time.

While you can always check the U.S. Money Reserve for gold spot prices to see how they change, remember, you cant buy gold at a spot price. However, you can buy it close to the amount of the spot price. For more information, check out the price chart for gold.

Also Check: Where To Sell Gold Rdr2

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

Is A Gold Etf The Same Thing As Buying Physical Gold Bullion

No, theyre not the same at all. There are actually crucial differences between bullion and ETFs.

Yes, you can invest in gold ETFs if you prefer to perhaps trade in the short term. However, it is important to understand that gold ETF exposure will not provide you with actual gold bullion that you can own and hold outside the financial system. Gold ETFs also always continuously charging fees which can eat into your investment capital over the years. You can find some of those fees, when you learn about the best ways to buy physical gold bullion.

While most gold ETFs are supposedly backed by gold, you will likely not pay the bullion price nor receive any gold bullion at all for your investment. They are priced very differently, and they trade on the market in a completely different manner than physical gold, as well. Theyre also affected by other forces, so they may not make a good investment choice for your specific situation. If youre considering an ETF rather than physical bullion, think long and hard about it. Most investors prefer owning the actual physical precious metal itself. Gold ETFs often obstruct investors from many of the best safe haven aspects which actual gold bullion offers.

Also Check: How Much Is 10k Gold Worth

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

What Is The Gold/silver Ratio

It is the number of ounces of silver required to buy one ounce of gold. Silver and gold price chart history and the fluctuating gold/silver ratio is often used by investors to analyze how much silver is worth in comparison to gold, to evaluate if one of the two is overpriced at any given time. This enables investors to determine whether it is a favorable time or not for either buying or selling one of these commodities.

Recommended Reading: Is Dial Gold Body Wash Antibacterial

What Is The London Fix Price

Gold trades around the world and around the clock. Some of the larger exchanges include New York, London, and Shanghai. Gold trades from 6AM to 5:15PM Eastern Time, Sunday through Friday . The spot price constantly fluctuates during trading days, depending on what buyers and sellers are doing.

The London market provides a fix price twice per day for gold at 10:30 a.m. and 3:00 p.m. and once per day for silver . It is designed to establish a price for settling contracts between members of the London bullion market, but it informally provides a recognized rate that is used as a benchmark for pricing the majority of gold products and derivatives throughout the world’s markets.

The London fix on any given day is determined through a conference call among 12 of the worlds largest private banks. It is then used by institutions, producers, and other large market participants to price contracts.

Retail customers like you and I cannot buy and sell based on the fix price, only the spot price .

How Does The Gold Bar Price Vary From The Ounce Of Gold Price

Gold is available in many different forms, including modern gold coins, gold bars and older collectible gold coins.

The gold bar price will vary depending on the amount of gold in the bar. If the bar contains one ounce of gold, the price will typically be slightly less per ounce than the gold price for government guaranteed and minted gold bullion coins or other similar gold bullion collectible items. However, if the gold bar contains more or less gold, the price will vary mostly depending on overall weight. For instance, a one gram gold bar will not cost the same as an ounce gold bullion bar or a one kilo gold bar.

Make sure to know the exact amount of gold bullion contained in any gold bar or gold coin before purchasing or selling to ensure that you are indeed getting a fair price.

Recommended Reading: How Much Is 10k Gold Worth