Value Of The Us Dollar

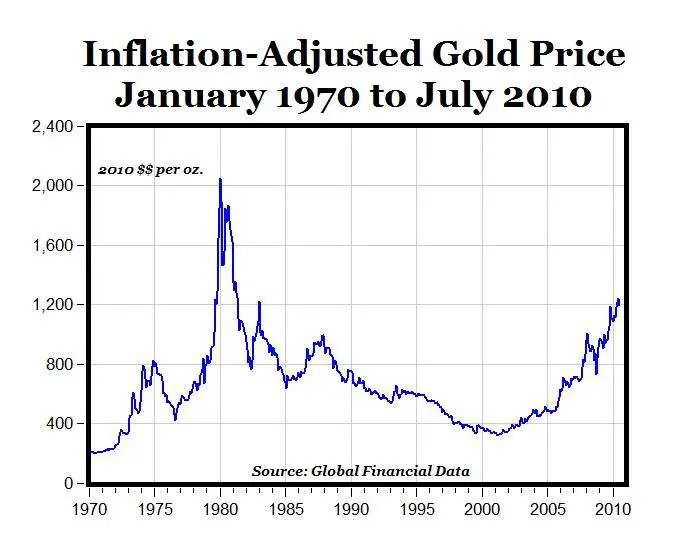

The price of gold is generally inversely related to the value of the United States dollar because the metal is dollar-denominated. All else being equal, a stronger U.S. dollar tends to keep the price of gold lower and more controlled, while a weaker U.S. dollar is likely to drive the price of gold higher through increasing demand .

As a result, gold is often seen as a hedge against inflation. Inflation is when prices rise, and by the same token prices rise as the value of the dollar falls. As inflation ratchets up, so too does the price of gold.

Factors That Influence The Gold Market

Gold is one of the most important commodity markets in the world, with only crude oil being more valuable. Despite this, the bullions price doesnt function on the basis of supply and demand. As is typical of most commodities, their prices are determined by expected demand and market supply.

Prices tend to rise when demand is high and inventories are low however in the case of gold, price are more heavily influenced by fluctuations in the currency and interest rates.

Some analysts like to think of gold as a currency instead of a commodity because of its intrinsic value. It is commonly believed that gold prices are driven by sentiment instead of traditional market factors. Gold has traditionally had an extremely inverse relationship with bond yields and the US dollar. Heres the rule of thumb: when the dollar and interest rates go down, gold rates soar.

Gold Rates Increase To One

Gold and silver rates had increased in the Indian markets and tracked firm global prices. On the MCX, the gold futures for February had increased by 1.4% and reached a one-month high and reached Rs.51,009 per 10 gram and the silver futures had increased by 5.4% and reached Rs.71549 per kg.

In the international markets, the gold rates had increased after top U.S. lawmakers agreed on a $900 billion COVID-19 economic relief package. The spot gold had risen by 1.1% and reached $1,900.57 per ounce. The silver rates had increased by 4.5% and reached $26.93 per ounce.

21 December 2020

Read Also: Gold Earring Rdr2

Understanding The Dow To Gold Ratio

The Dow to gold ratio is a measure of the stock market in comparison to gold. The Dow gold ratio been observed to move downwards in the wake of panic associated with inflation and deflation. During the Great Depression, the Dow to gold ratio stood at 1:1. In January 1980, both the Dow Jones Industrials and gold prices sported a handle at 850, thus reaching 1:1 ratio.

The Dow to gold ratio has fluctuated from 16 to 20 between 2017 and 2018. Analysts believe that the ratio will fall in favor of gold during the next financial crisis while some believe that the ratio will return back to 1:1.

As an example, a 20,000 Dow and $20,000 gold price may seem impossible to achieve today but when panic spreads in the market, price extremes on either side could be reached, sometimes even simultaneously.

India Gold Price On 22 July 2021

The spot price of gold on Thursday, 22 July 2021 at Rs.48,110 was considered 0.16% lower than this weeks average of Rs.48,187. Thursdays gold price was also lower than that of Wednesday, 21 July 2021 value of Rs.48,120. After the drop in prices, the Multi-Commodity Exchange future prices also saw a drop of Rs.99.7 with 10 grams of gold valued at Rs.47,481.

23 July 2021

Recommended Reading: Permanent Gold Teeth New Orleans

Does The Monetary Denomination Of A Gold Coin Affect Its Overall Value

Not particularly. Having a legal tender status, in and of itself, can help increase the total value of a coin. But the actual face value or denomination has little to no bearing on that value. It doesn’t mean the coin contains an amount of gold worth the face value. It’s actually much higher.

Typically, the specific issuing country will have more effect on the total value of the coin. Investors prefer coins minted by major economic powers, such as the U.S., China, Great Britain, or Canada.

How Does The Price Of Gold Perform During Recessions

Gold prices typically increase during economic recessions. One way to analyze gold prices during a recession is by comparing its performance with the S& P 500. Below are the dates of the largest declines of the S& P 500 and the performance of gold prices during the same period. This data shows that gold increased significantly in 75% of these recessions.

Recommended Reading: How To Get Free Golden Eagles In War Thunder

Details Of Gold Price In India For November 2020

- In the country, the gold rate in India in November opened the month at Rs.5,194 per gram on 1 November and showed an inclining trend for the first week due to the uncertainty around the U.S. elections.

- On 3 November, the price of the metal had increased to Rs.5,268 per gram and further increased to Rs.5,416 per gram on 5 November as Europes lockdown continued due to the rise in COVID-19 cases.

- The price of the metal on 7 November was Rs.5,461 per gram and increased to hit its weekly high at the end of the week at Rs.5,504 per gram on 8 October.

- In India, gold opened the second week of November at Rs.5,505 per gram. When compared to the closing price of the previous week, the price of the yellow metal was up by Re.1.

- The price of gold increased in the country the next day and was retailed at the highest recorded price for the month till date. A gram of the 24-karat gold was retailed for Rs.5,525 on the mentioned date.

- Gold rate in India closed the week at Rs.5,428 per gram. The overall performance of gold witnessed an inclining trend.

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Also Check: Can I Buy Gold Jewelry From Dubai Online

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

Gold As An Investment In India

Indians primarily invest in gold as a means to counter inflation. While the price of gold may fluctuate over time, the value of this metal remains relatively stable, especially in the long-run. Returns on gold are generally higher in the long-run as compared to other asset classes. Real estate and equity markets have proven to be the exceptions but for most Indian investors, gold still forms a huge part of their investment portfolios.

Traditionally, investment in gold has been in the form of jewelry gold bars or gold coins. As financial markets developed over the years, new investment avenues have opened up. Gold is now increasingly being invested in through Gold ETFs or through mutual funds which invest in gold or through stocks of companies that are in the business of gold/gold-related activities. Gold is also traded as a commodity on commodity exchanges.

Investments in gold commodities, ETFs, funds and stocks can be done online adding another dimension to gold investments in India.

Recommended Reading: Does Kay Jewelers Sell Real Gold

Is Gold Traded 24 Hours A Day

Yes. Gold trades on exchanges located around the world. Even when one exchange is closed for the night, there is another somewhere else that is active.

Electronic trading of gold goes on continuously. This is reflected in the Globex gold price overseen by the CME Group. Globex prices are updated moment to moment based on futures trading.

24-hour gold trading means that gold product prices always fluctuate.

Gold Prices Fall In India On 20 May 2021

Due to a muted trend in the global markets, gold prices fell in India on 20 May 2021. Gold futures prices for the month of June on MCX fell by 0.29% and were at Rs.48,531 for 10 grams. On 19 May 2021, gold prices saw a roller coast ride because of the cryptocurrency sell-off. Gold futures prices in the international markets settled at $1,881.50 for an ounce. On 19 May, gold prices on MCX hit a high of 4.5 months. Like gold, silver futures prices for the month of July fell by 0.39% and were at Rs.72,094 for a kg.

21 May 2021

Read Also: Where To Sell Gold Bar Rdr2

What Are Bid And Ask Prices

The ask price is the lowest price at which a dealer is willing to sell a troy ounce of gold. The bid price is the lowest price that a dealer is offering to pay for a troy ounce of gold.

This why the current price is important to know if you are buying gold bullion or you want to sell gold to a dealer.

The difference between bid and ask prices is called the dealer spread.

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

Also Check: Free Golden Eagles App

Know About Gold Rate In India

India is the largest consumer of gold in the world, accounting for almost a quarter of the worlds total consumption. It has, since long, maintained this position and, unlike countries like China, India uses gold primarily in the form of jewelry and investments. It is viewed as a solid instrument for investments and even traders who are into commodities trading, invest in gold bullion. These investments are usually dictated by the gold rates prevailing in the economy at that time.

Even the global view of gold is that of a safe haven where you can invest even when investments in the economy of a country are not a good idea.

Gold rate in India change on a daily basis, with a number of factors impacting their price in a particular place on a given day. Demand and supply, global market conditions and currency fluctuations are some of the most critical factors which go into determining the rate of gold in a country, with prices changing every day.

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

Read Also: 1 10 Oz To Grams Gold

Gold Prices Steady At Rs 51147/10 Gm

Prices of gold gold remained flat at Rs 51,147 per 10 gram in the Mumbai retail market due to a weaker rupee and negative global cues. The yellow metal traded flat as dollar rebounded after hitting a session low of $1,915/oz.

The US dollar index traded marginally higher at 93.23 levels up 0.14% .

The price of 10 gram 22-carat gold in Mumbai was Rs.46,851 plus 3% GST, while 24-carat 10 gram was Rs.51,147. The 18-carat gold was recorded to be at Rs.38,360 in the retail market.

The gold/silver ratio stands at 82.24 to 1, which means the amount of silver required to buy one ounce of gold.

Silver prices dropped Rs.418 to Rs 62,188 per kg from its closing on October 12.

14 October 2020

Gold Lacklustre As A Strong Dollar Weighs Heavy

Gold showed a lacklustre performance in the domestic market in the early trade on January 18, due to the rise in the US dollar.

On the Multi-Commodity Exchange , February gold contracts dropped by 0.07% percent at Rs.48,668 for 10 grams.

Gold prices slipped to Rs.48,702 per 10 gram in the previous trading session on January 15, as investors increased their short position. Gold ended with a loss of Rs.116 or 0.24% for the week.

18 January 2021

Also Check: How Much Is 10k Gold Worth

Why Investors Prefer To Buy Gold

Investors see gold as opposing power against bad central-bank policies and inflations. Most of the investors observe gold as insurance against the financial instability, uncertain situations, high government expenditures, non-desirable policy of the central bank. The standard 24k gold becomes the ideal choice when real returns on bonds and cash are decreasing or falling, irrespective of a rise of the nominal interest rate.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Recommended Reading: Coleman Dental Gold Teeth

Trend Of Gold Rate In India For April 2021

| Parameters | |

| Rs.5,086 per gram on 23 April | |

| Lowest Rate in April | Rs.4,042 per gram on 18 April |

| Overall Performance | Incline |

- The price of gold in India at the start of the week was Rs.4,717 per gram. When compared to the closing price of the previous month, the price for every gram slipped by Rs.28.

- Over the week, gold prices in India climbed and recorded its highest price for the month till date on 4th April. A gram of the precious metal cost Rs.4,846 on the mentioned date.

- Gold price in India witnessed an inclining trend over the week.

- Gold price in India opened the second week of the month at Rs.4,846 per gram on 5 April and was steady on the following day due to mute trends seen in the international market.

- On 7 April, the price of the yellow metal increased to Rs.4,860 per gram and further to Rs.4,888 per gram on 8 April as the value of the U.S. Dollar fell in the market prompting investors to shift to the bullion market.

- The price of gold on 9 April was Rs.4,926 per gram and inclined further to hit its highest in the week and the month at Rs.4,980 per gram on 11 April.

Worldwide Jewelry And Industrial Demand

In 2019, jewelry accounted for approximately half of the gold demand, which totaled more than 4,400 tonnes, according to the World Gold Council. India, China, and the United States are large consumers of gold for jewelry in terms of volume. Another 7.5% of demand is attributed to technology and industrial uses for gold, where it is used in the manufacturing of medical devices like stents and precision electronics like GPS units.

Therefore, gold prices can be affected by the basic theory of supply and demand as demand for consumer goods such as jewelry and electronics increases, the cost of gold can rise.

You May Like: Where To Sell Gold Rdr2

Gold Prices Hit Record Highs For The Third Consecutive Day On 20 February 2020

The prices of gold in India increased again on 20 February 2020 for the third day in a row. Gold futures prices for the month of April increased by 0.5% and hit Rs.41,798 for 10 grams.

The prices of gold in India tracked the rates in the global market, which hit around seven-year highs. According to a note made by SMC Global, gold prices could move towards the Rs.41,900 levels and may take support near the Rs.41,600 levels. In the international market, the prices of gold nearly hit a seven-year high due to the impact of the coronavirus. The prices of gold in the international markets have increased by around 6% so far this year. Prices of spot gold were steady and were trading at $1,610.43 for an ounce. China announced that the interest rates have been cut in a move to improve the economy. The economy has been down due to the impact of the coronavirus. Expectations are also there for China to take certain measures to improve the economy. According to a few analysts, the prices of gold could go above $1,650 in the coming weeks. US Central Bank policymakers are optimistic that the interest rates can be held steady this year. However, they acknowledged the presence of new risks due to the coronavirus outbreak.

20 February 2020