Select A Gold Storage Facility

Section 408 prohibits personal storage of precious metals and holding coins using a self-directed IRA.

This means that you cant buy gold and similar precious metals and store it in the drawer of your house. And if the gold was scratched or handled in your home, there is a chance that you might not be able to transfer it to your gold IRA.

Gold needs to be stored in specialized IRS-approved gold storage, like Brinks and Delaware Depository.

So before you buy gold, you must open an account in a trust-worthy storage facility to store the gold youve purchased. You cant store your gold temporarily in your home and transfer it to a storage facility afterward as you may incur penalties for doing so.

Usually, gold IRA companies have connections to reputable IRS-approved gold storage facilities.

Its worth inquiring about these facilities and seeing if theyre a proper fit for you. Ask about their fees, insurance policies, safety measures, and record-keeping capabilities. If theyre up to your standards, open an account with them to store your gold.

Some of the best gold IRA-approved depositories include:

- Delaware Depository Service Company

Reasons To Avoid A 401 Rollover

There are some cases when it doesnât make sense to roll your 401 into another account:

⢠IRAs are less protected. If you end up declaring bankruptcy later, a 401 offers more protection from creditors than an IRA.

⢠Higher fees. Depending on the situation you could end up with higher fees when you roll an old 401 into a new 401. Check the fees associated with the new account before you move your money.

⢠Limited investment choices. A new employerâs 401 might have more limited investment choices. If thatâs the case, you might want to stick with your existing 401 because the assets work better for your situation.

⢠A 401 gives you access to the rule of 55. With a 401, you might be able to begin taking withdrawals from your account penalty-free before age 59 ½ if you leave your employer after age 55. While IRAs donât have this feature, you may be able to emulate it by taking subsequently equal periodic payments from your IRA.

Can I Store My Ira Precious Metals Myself

The IRS requires that precious metals owned by an IRA be stored in the possession of a trustee or custodian. The IRS code also states that The trustee or custodian must be a bank, a federally insured credit union, a savings and loan association, or an entity approved by the IRS to act as trustee or custodian.

26 U.S. Code § 408. However, many IRA holders use what they believe is a loophole in the US Tax Code that allows the account holder to self-store the metals using a checkbook control IRA, LLC IRA, or Home Storage IRA. Midas Gold Group does not generally recommend using this structure as it has never been approved or recognized by the IRS. Storing your IRA metals at home may expose the IRA account holder to a material risk of IRS penalties. Custodians who offer a Checkbook IRA structure mostly recommend that clients hold the IRA metals in a bank safety deposit box.

Read Also: Best Western Gold Crown Club

What Types Of Gold Can I Purchase With A 401 K Rollover

When investing in gold with a 401 k rollover, you can purchase physical coins, bars, or stock in gold companies. You can also buy gold bullion, gold coins, gold bars, and other collectibles with a purity greater than 95%.

It is important to note that in order to avoid being duped when purchasing minted coins and other collectibles, it is necessary to obtain IRS permission first.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Also Check: Gold Coin With Angel On Both Sides

Decide On Your New Investments

Once you have completed your direct or indirect rollover, you can determine how you want to use your money. You can invest in physical gold, or you can look at index mutual funds. Diversifying your portfolio can protect it from market fluctuations.

Many people buy gold coins and bullion, but there are some drawbacks to these investments. You may have to pay broker commissions and fees for storing the gold. If you want to diversify your gold portfolio, you can invest in gold using other techniques as well.

- Gold futures and options: These contracts are essentially agreements to buy or sell gold at a set price in the future. Because these contracts are traded on commodity exchanges, they are tightly regulated by the federal government.

- Stocks in gold mining: If you want to invest in gold mining and refining businesses, you can buy stock in a mining company. You should always research the company beforehand to see if they are financially stable. To reduce your risk, you can also buy shares in a mutual fund that invests in gold mining.

- Gold exchange-traded funds : An ETF is a basket of other assets. A gold ETF may own gold options, futures and physical gold. While mutual funds can only be exchanged after the market closes for the day, an ETF can be traded when the market is open.

Choose A Gold Ira Company

The first step in moving your 401k to gold IRA is, of course, choosing a reputable gold IRA company to work with.

Gold IRA companies that have been working with the gold industry for decades are your best bet.

These companies will provide you with accurate steps in investing in gold and help you choose your precious metals along the way.

Theyll also be able to help you decide where and when to store your gold.

There are multiple factors to consider when choosing a gold IRA company, including reputation, customer reviews, company history, and fees.

Seek out personal references from people close to you, like family and friends. Browse through reviews and testimonials from platforms like the Better Business Bureau and the Business Consumer Alliance. Dont rely on a single source as reviews can easily be faked or bought.

Avoid companies that make huge and unsupported claims, such as those that guarantee massive profits in a suspiciously short time to lure in retirees.

Unlike stocks that can swing astronomically within a few months or even weeks, gold takes several years to increase in value. Any company that promises quick profit isnt to be trusted.

Finally, take a look at the companys fees.

Fees vary from company to company some offer annual storage and management fees while others charge taxes on interest earnings. Ask the company to lay out every fee imaginable, including any potential hidden fees, to avoid any nasty surprises later down the road.

You May Like: How Safe Is Gold Investment

How Do You Move A 401 Into Gold

Now that you have made the exciting decision to buy gold, the next step is figuring out how to actually carry out your plan. Most likely, your current 401 plan does not offer gold investment options. Many 401 plans offer limited investment options, so you need to find a new plan that allows you to invest directly in gold.

To avoid paying taxes on this transition, you will have to do a 401 rollover. A 401 rollover is when you transfer funds from your old 401 plan to a new one. You can transfer money to a new 401 or IRA.

According to the Internal Revenue Service , you must complete this transfer within 60 days. If you do not finish it in time, your transaction is treated like a 401 withdrawal. Unless you want to pay taxes and penalties on your withdrawal, you must follow the IRS rules.

When you convert to a new 401 or IRA, you can enjoy new perks. Employer plans generally have limited options and high fees. An employer typically offers the plan as a benefit to their employees, but they do not have an incentive to shop around for a great plan. Because of this, you may need to get a new 401 if you want cheaper investments, lower account fees and more gold investment options.

In order to convert your 401 plan to a gold IRA or 401, you have to do the following steps.

- Pick the account you want.

- Open your new account.

- Talk to your previous 401 plan about doing a direct rollover.

What Is Gold Ira

A Gold IRA is an Individual Retirement Account that allows investors to hold physical gold, silver, platinum, and palladium coins in their retirement savings. The custodian owns these precious metals on behalf of the account holder, and all profits from these investments are tax-deferred until withdrawals start at age 59 ½.

Recommended Reading: How Much Can I Put In A Solo 401k

Read Also: What’s The Current Price Of Gold

Where Can I Move My 401k Without Penalty

Direct rollovers. A direct 401 rollover gives you the option to transfer funds from your old plan directly into your new employers 401 plan without incurring taxes or penalties. You can then work with your new employers plan administrator to select how to allocate your savings into the new investment options.

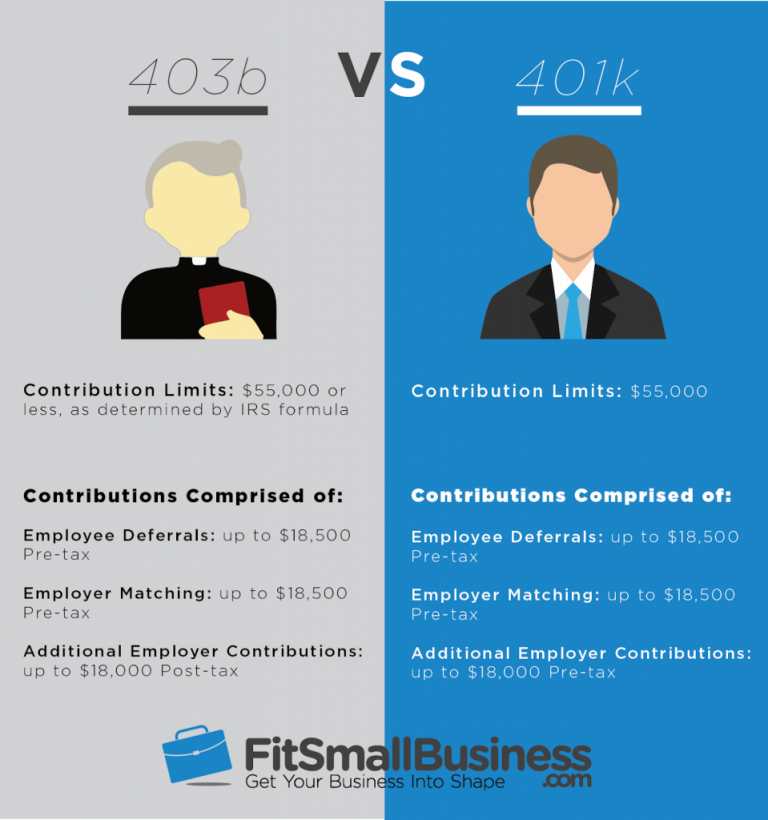

What Are The Contribution Limits For A 401 How Do They Affect My Self

Every year, the IRS revisits the contribution limits for 401sand potentially other retirement vehiclesfor the upcoming year. This can result in changes. And as of November 2021, it did.

In 2021, the IRS made several key adjustments to the 401 contribution limits for the 2022 tax year.

- For employeesThe contribution limit for individual employees was $19,500 for 2021 and increased to $20,500 for 2022. In the event that an employee has multiple 401 accounts, this contribution limit is valid for the total contributions across all accounts and includes both contributions to traditional and after-tax contributions to Roth 401 accounts.

- For employersThe contribution limit for employers is calculated along with employee contributions. For 2021, this combined contribution limit is $58,000, with a limit of $64,500 in the event of catch-up contribution . For 2022, the combined contribution limit is $61,000, with a limit of $67,500 if there is catch-up contribution eligibility.

- Catch-up contributionsEmployees who are 50 years of age and older are allowed to make additional contributions to their 401 in order to accelerate their savings. The 2021 catch-up contribution limit is $6,500. In 2022, the catch-up contribution limit remains at $6,500.

When you work with a Precious Metals Specialist to review your existing retirement accounts and identify which ones you would like to roll over or transfer into your SDIRA, they will help you identify which ones are eligible to be moved.

Don’t Miss: How Much Is Xbox Gold Per Month

K To Gold Ira Rollover

You need to do a 401 to gold IRA rollover in order to transfer your 401 to an IRA backed by gold. Not many 401 plans allow you to invest in precious metals such as gold. If yours does not, you will have to invest in a reputable gold IRA or self-directed/solo IRA by rolling over your 401.

The process of rolling over a 401 plan to a Roth or traditional IRA isnt difficult. Many investors choose to do this when leaving a former employer because they prefer to keep all their retirement savings in the same place.

Another reason to invest in precious metals is to diversify your retirement savings and its a wise choice to invest in assets not closely tied to the economy so their value should stay stable regardless of what happens economically. If this is your concern, a 401 to gold IRA rollover might be the best solution for you. An experienced gold IRA advisor will be able to offer guidance and design a retirement plan to suit your goals and requirements.

How To Transfer A 401k To Gold Without Penalty In 2023

Disclaimer: Bluehillresearch.com is a reader-supported site. We may earn a commission if you click on links and make a purchase.

If you have a 401k and want to roll over to a gold IRA without penalty, there are several steps you can take. You will need to find a new custodian to handle your 401k funds, and then you will need to transfer the assets to your new custodian.

Also Check: 14 Karat Gold Diamond Ring

One Create Your Gold Individual Retirement Account

So, your first step in getting a Gold IRA is to research Gold IRA companies and choose one to set up your account. Your choice will likely, in addition to the factors outlined above, depend primarily on things such as your level of investing expertise and how hands on you want to be in the management of your Gold or Silver IRA.

Part of the account setup process also involves making a decision as to whether you want your account set up as a traditional IRA or as a Roth IRA, a subject that weve already covered.

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether youre a manage it for me type or a DIY type.

-

If youre not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Read Also: How Much Is 1 Gold Bar Worth

Fund Selection And Fees

Ideally, you want low-cost fund options with no administrative fees. Consider the choices available with different brokerages to minimize the administrative or brokerage fees you may pay.

When it comes to fund selection, the sheer volume of choices can feel overwhelming. Beginner or hands-off investors may benefit from target date funds or robo-advisors that manage retirement funds for you based on your risk profile.

If you prefer to manage investment choices on your own, most advisors recommend beginners start with a simple portfolio of a broad U.S. stock index fund, a broad international stock fund and a U.S. bond fund. For more on how to invest for retirement, check out our guide.

Transfer Your 401k Assets Into A Gold Ira Account

To make a successful 401k transfer into your new Gold IRA you must contact your 401 k plan administrator and initiate a money transfer. You must then decide how much money you want to allocate towards precious metals as part of your overall financial planning, which usually is specifically for retirement purposesand consult with a Gold IRA trustee if necessary.

Don’t Miss: Is Dial Gold Body Wash Antibacterial

Frequently Asked Questions On How To Transfer 401k To Gold Without Any Penalties

What is a Gold IRA rollover?

This is the process of moving funds from a retirement account to an IRA that is backed by precious metals such as gold, silver, platinum, or palladium. This is often done through the direct or indirect transfer of funds from the former retirement account to the gold IRA company or custodian.

What are the IRS for 401 to gold IRA rollovers?

The IRS has very strict rules pertaining to IRA rollovers. As per the set regulations, investors have a 60-day window from the date they received their funds to deposit them in the gold IRA company or the gold IRA custodian. The failure to complete this transaction within 60 days will only lead to the funds being viewed as a taxable withdrawal, for which the IRS will slap an extra 10% early withdrawal penalty if youre 59.5 years or younger. Note that you can only do one rollover per year.

Which type of gold can you hold in a gold IRA?

Note that the IRS only allows you to add gold that meets the 0.995 purity requirement to your gold IRA. Some of the items that qualify include:

- The American Gold Eagle coin

- The Austrian Philharmonic gold coin

- The American Gold Buffalo coin

Transferring A 401 To A Gold Ira

A gold IRA is a special retirement account that allows you buy physical gold bullion and precious metal coins. You can even invest in silver, platinum and palladium. If you want to do a rollover, you must complete a form called a 1099R. This document helps the IRS know how much money you transferred out of your old retirement account. In most cases, you cannot take the cash value of your assets out of the plan. Instead, you must sell them and pay taxes on the proceeds. You can use the proceeds to purchase gold, silver, platinum, palladium or any other precious metal.

Also Check: White Gold Square Diamond Ring

Top Companies To Convert Your 401 Into Gold

Several companies will help you to invest in gold and otherprecious metals through your IRA and/or 401. However, the fees and termsvary widely from one to the next. So, do your research and read all the fineprint in detail before you open your new account with one of these companies.According to our own research, below are the three best companies at currentthat can assist you with investing in gold.